We recently brought together Data & Insight business leaders and industry experts from our network to discuss how AI is reshaping competitive advantage, value creation and investor expectations in the sector.

AI is reshaping competitive advantage

AI systems can increasingly automate the collection, cleansing and aggregation that previously underpinned proprietary data generation. As the technology continues to be rolled out, data that was once considered proprietary may not be so anymore. Data workflows and processing are also being commoditised, eroding competitive advantage based solely on data analytics and presentation.

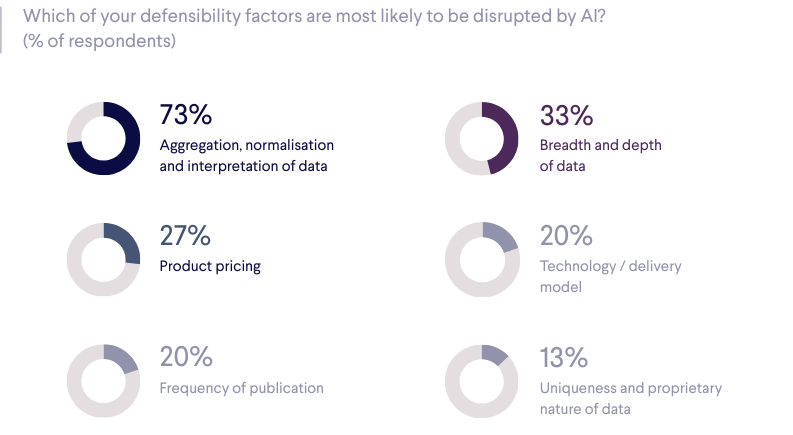

This trend is being accelerated by the proliferation of publicly available and machine-readable data, which is in turn driving the uptake of AI. At Bowmark’s recent roundtable, 73% of participants cited aggregation, normalisation and interpretation as the functions most at risk from AI disruption.

AI has also made data that is truly proprietary even more valuable

Today, organisations with domain expertise and proprietary data and taxonomy are best placed to deploy AI effectively. Properly structured, domain-specific data enhances AI performance, enabling more accurate and relevant outcomes – while the application of expert “human-in-the-loop” oversight enhances customer acceptance and subsequent adoption.

For example, Bowmark-backed Helio Intelligence, Europe’s leading provider of political monitoring and intelligence services, has deployed a proprietary model trained on 25 years of curated data. It analyses 70 million content items refreshed in real time from more than 4,000 sources to deliver unique insights to customers.

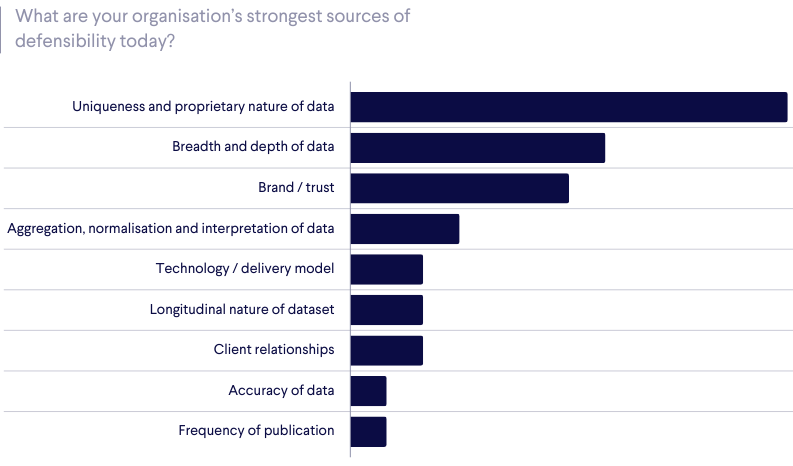

Proprietary data is still a fundamental source of competitive advantage – but only as part of a broader AI solution

Proprietary data remains the cornerstone of a data company’s differentiation but no longer guarantees competitive advantage on its own. Workflow integration, data structure and efficient delivery are becoming ever more important as customer processes digitise.

Customers increasingly expect providers to embed AI into their proposition to enrich existing datasets and insight. The most advanced players in the market are combining proprietary data with AI-driven analytics to enhance the customer proposition and build shareholder value.

As Fergus Jarvis of BCG noted: “Today, investors are adjusting for the significant premium applied to information services assets over the past few years – simply for the mention of AI – with valuations staying flat or slightly increasing for companies with a clearly articulated AI strategy. Those without are getting a 30%+ haircut, underlining that a credible AI story is now a key valuation driver”

Data providers need to adapt their strategies to remain competitive

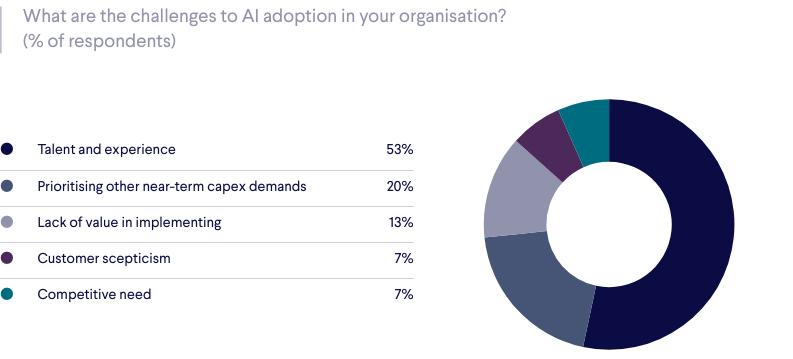

To remain competitive, firms must prioritise investment in data infrastructure, integration and delivery – the foundations of effective AI implementation. The most pressing challenge in doing so – as noted by the Bowmark roundtable attendees – is talent: the ability to hire and retain the right people who can execute AI and translate insight into product advantage.

With AI rapidly reshaping competitive advantage in the Data & Insight sector, market participants must act now to stay ahead. Those that combine proprietary data and taxonomy with strong data architecture, workflow integration and AI capability will build client trust and deliver long-term value for their investors.

Associated investment

Helio Intelligence

Helio is the leading provider of political intelligence and monitoring services across Europe

Read more

In the news

26 February 2026

Bowmark hosts annual portfolio People and Talent Forum

Read more

17 February 2026

Littlefish Group acquires cyber specialist Stripe OLT

Read more