Strategic Value Drivers

Strategic priorities have shifted fuelled by renewed optimism about the future. Our survey revealed that 45% of companies are prioritising investment in technology and innovation to drive growth in the coming years. Other strategic initiatives include expanding into new markets (20%), enhancing operational efficiency (10%), and forming strategic partnerships and alliances (10%).

“Forming strategic alliances and investing in innovative technologies are pivotal for our growth strategy,” remarked one respondent, highlighting the focus on leveraging technology and innovation to accelerate revenue growth. As one CEO noted, “investing in technology and innovation is essential for staying competitive in today’s market.”

Emerging Technologies

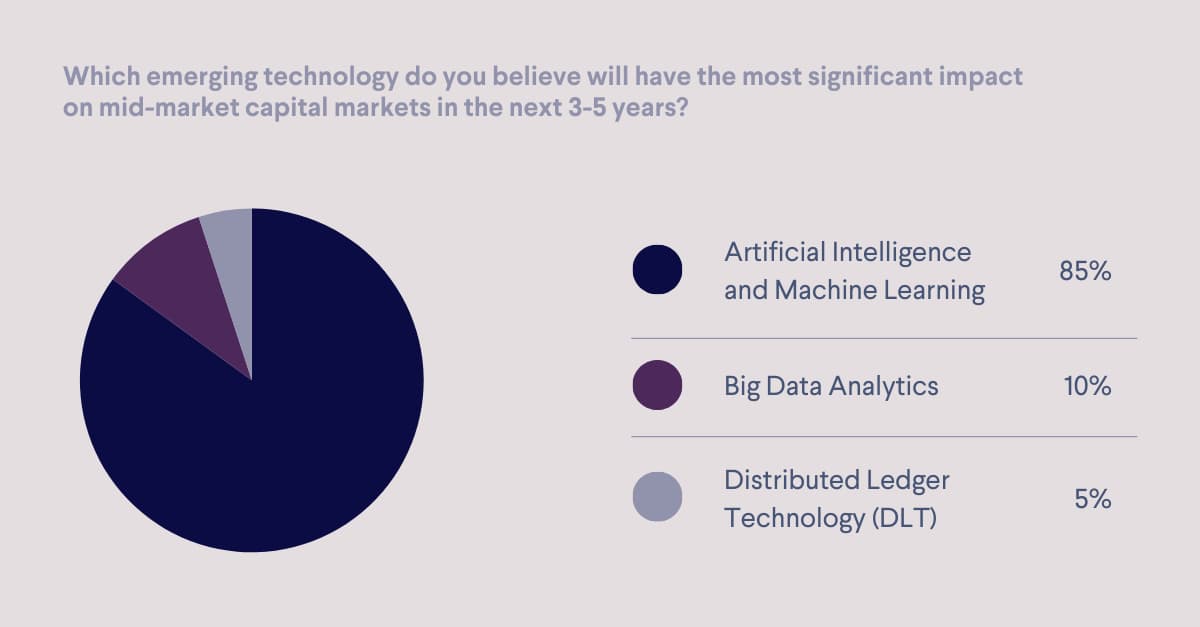

85% of CEOs identified Artificial Intelligence (AI) and machine learning as the technologies poised to have the biggest impact on providers of capital market infrastructure over the next three to five years. AI is expected to revolutionise the industry by enhancing decision-making processes, improving efficiency through automation, and enabling advanced data analytics. It is now seen as essential due to client expectations and proven, profitable use-cases. One respondent noted, “AI's potential to deliver efficiencies, enhance decision-making, and improve engagement with our customers makes it transformative for private equity-backed businesses such as ours”.

In contrast, Distributed Ledger Technology (DLT) garnered only 5% of respondents' votes as the most impactful technology. DLT's promise lies in its ability to provide transparent, secure and immutable records of transactions, which can enhance trust and efficiency in trading and settlement processes. However, the slower adoption rate of DLT compared to AI may be attributable to the substantial infrastructural changes required, resulting in slower payback, with the focus of many firms being on more immediately transformative AI applications. As one respondent mentioned, “DLT has significant potential, but the transition to its widespread adoption requires a considerable overhaul of existing systems, which many firms are not yet prepared for”.

Current Challenges

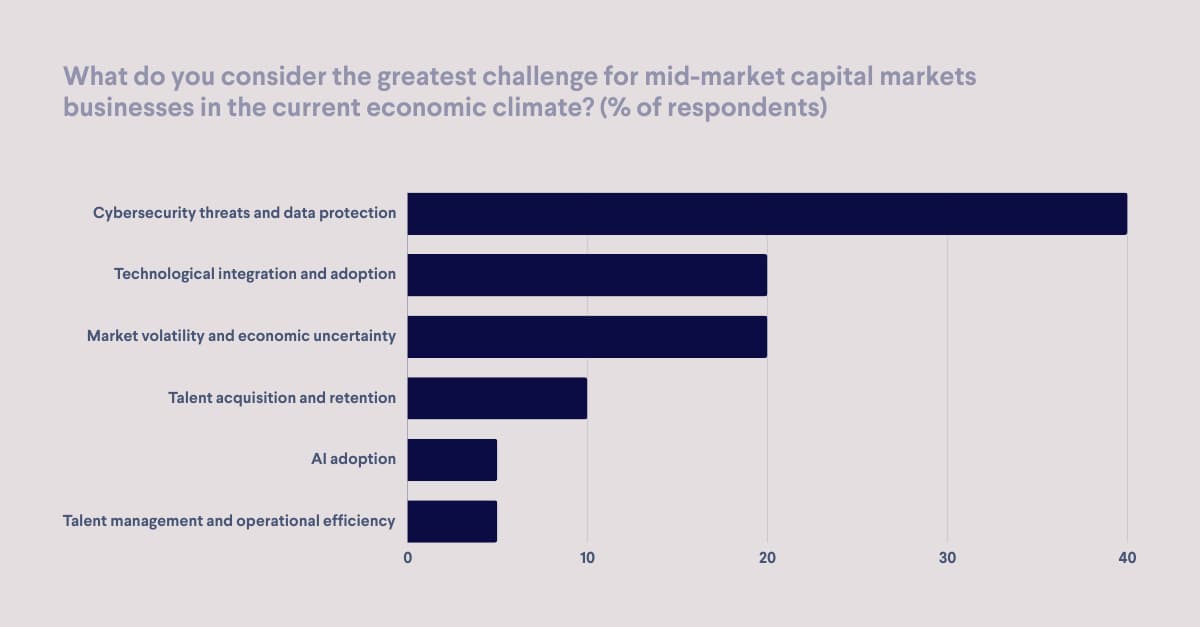

Cybersecurity emerged as the foremost concern, cited by 40% of respondents. The response to the threat of cyber attacks has evolved from simply defence, to investing in post-incident response and resilience given the increasing likelihood of an attack. One respondent highlighted, “we continue to do our utmost to stop any incident, but importantly, we are now placing a lot more focus on reaction and combating an incident.”

Other challenges raised by respondents included difficulties in accessing capital, increased competition, and the pressure to innovate while managing costs. Although AI presents significant opportunities, some respondents also noted the risks associated with its uncontrolled adoption. One participant remarked, “AI, if not controlled properly, can pose huge risks, while its benefits are undeniable.”

Regulatory and Security Changes

Increasing customer security requirements and tighter regulatory frameworks are impacting the sector. The regulatory environment is seen increasingly as globally coordinated rather than regional. As one CEO noted, “opportunities for more agile, innovative firms are offset by rising barriers and costs driven by regulation.” Despite these challenges, there remains optimism driven by technological advancements and a resilient market structure. Another commented, “technology will drive businesses and regulators to evolve ways of working to delight customers. There is a lot to do and a lot to improve on.”

To address these regulatory challenges, some firms are enhancing their broader compliance standards. One respondent highlighted the importance of securing ISO 27001 certification, which is essential to meet the upcoming Digital Operational Resilience Act (DORA) regulations in January 2025. This underscores the critical role of technology in overcoming regulatory challenges and driving innovation and efficiency in the sector.

Optimistic Outlook

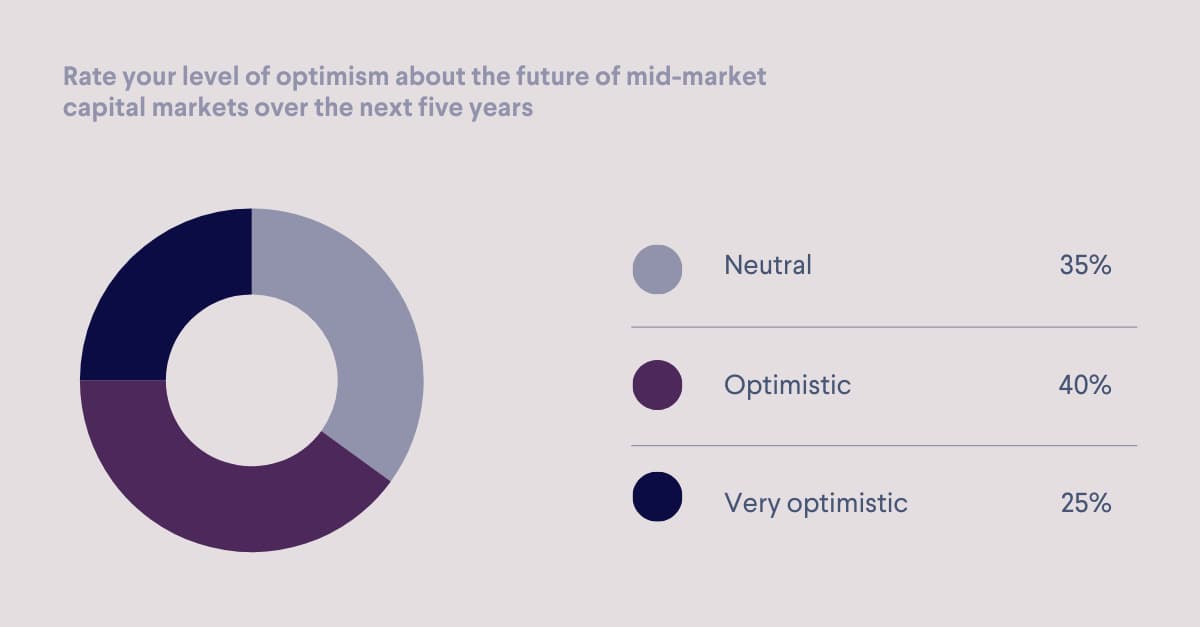

Despite macroeconomic uncertainties, 65% of respondents expressed optimism about the sector’s future, driven by technological advancements, regulatory support, and a resilient market structure. This positive outlook persists despite tightening global regulation, which some CEOs view as an opportunity for product and service expansion.

One participant summed up this sentiment: “Our optimism is driven by our belief in the transformative power of emerging technologies to drive efficiency and innovation in our operations.”

Looking Ahead

The survey results underscore the critical role of technology in shaping the future of the capital markets sector. AI and machine learning are expected to be transformative, while cybersecurity is the primary concern. Firms are prioritising investment in technology and innovation to drive growth and, despite macroeconomic uncertainties, the overall mood is one of optimism due to advancements in technology and customers’ ongoing requirements for efficiency and regulatory support.

As we look to the future, Bowmark Capital is committed to helping companies capitalise on these trends, enabling them to achieve sustainable growth through strategic investment in technology and innovation.