We recently brought together capital markets technology leaders and industry experts from our network to discuss how geopolitics, regulation and AI are reshaping strategy in the sector.

Rising global instability is disrupting cross-border operating models. This is being compounded by increasingly fragmented regulatory frameworks – such as the EU’s Corporate Sustainability Reporting Directive, the Securities Financing Transactions Regulation and the Digital Operational Resilience Act – which are making international expansion more complex and cost-intensive.

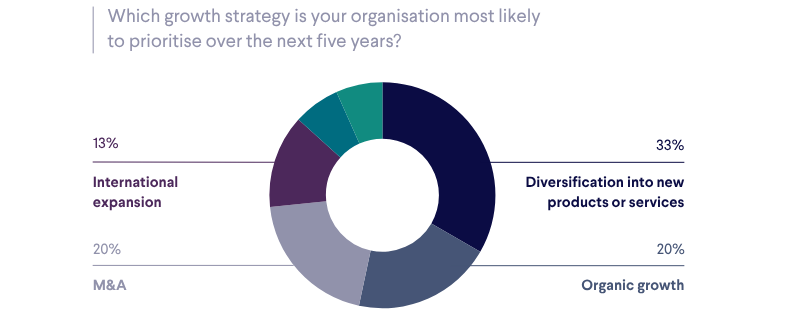

As a result, capital markets technology firms are recalibrating their strategies, prioritising domestic market innovation over international expansion. At the heart of this is AI.

AI has become an essential part of modern software platforms. However, large enterprise customers – particularly those operating in highly regulated environments –have been slow to adopt AI solutions. In addition, new legislation, such as the EU AI Act, has heightened the concerns around compliance, risk and governance.

In this context, firms that can successfully integrate AI into client workflows, tailoring it to their specific regulatory and operational needs, will win out. This means shifting the focus from showcasing AI’s potential to delivering customised solutions that enhance both operational efficiency and decision-making.

Human-in-the-loop design is the key to this. By embedding human oversight into AI systems, firms can ensure the transparency, accountability and trust which are fundamental in regulated financial environments.

Mathias Strasser, founder and CEO of Bowmark-backed WSD, shared how the company is developing Autocoder – an AI-powered engine which automates document creation for the structured products industry. Built around modern agentic AI principles, it generates compliant, multi-language templates for a broad range of complex investment products. WSD’s consultants remain at the core of the solution, supervising the process, ensuring accuracy, and testing the final outputs. In a highly regulated environment, this combination of automation and expert oversight delivers both efficiency and trust.

The capital markets technology sector is being reshaped by geopolitics, regulatory fragmentation and accelerating AI adoption. The firms that invest ahead of the curve in the talent and infrastructure to deliver the next generation of AI-enabled solutions, and can apply AI strategically to client problems, will be the winners in this rapidly evolving environment.

Associated investment

WSD

A provider of document and workflow automation software solutions to the global structured products industry

Read more

In the news

26 February 2026

Bowmark hosts annual portfolio People and Talent Forum

Read more

17 February 2026

Littlefish Group acquires cyber specialist Stripe OLT

Read more