Bowmark’s CFO Forum was an opportunity for finance leaders at our portfolio companies to debate the evolution of their responsibilities beyond the traditional bounds of accounting, finance and administration, and to discuss with Bowmark operational experts and independent advisers ways of unlocking and driving further value in their businesses. Our survey that accompanied the Forum shone a light on topics of crucial importance to CFOs.

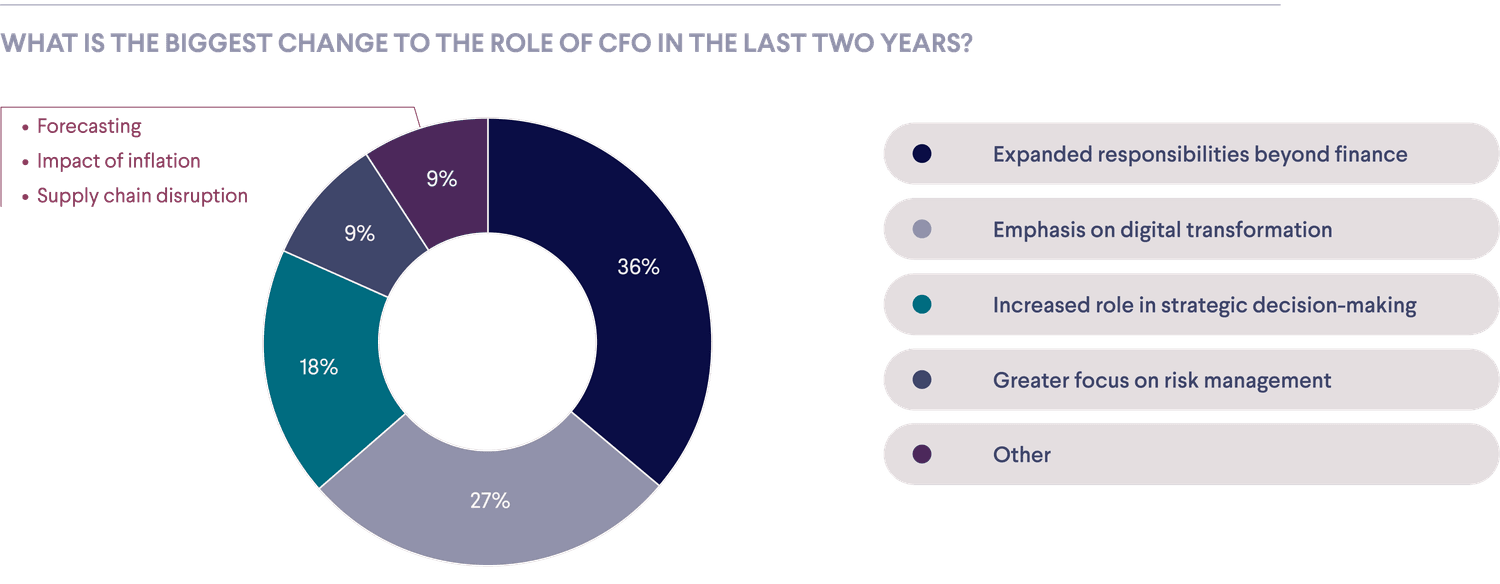

The demands on CFOs have grown in recent years as the business environment has evolved. Finance leaders have seen a variety of changes in their roles, the largest being the expansion of remits beyond traditional accounting and finance responsibilities. This is closely followed by increased emphasis on digital transformation and a greater role in strategic decision making.

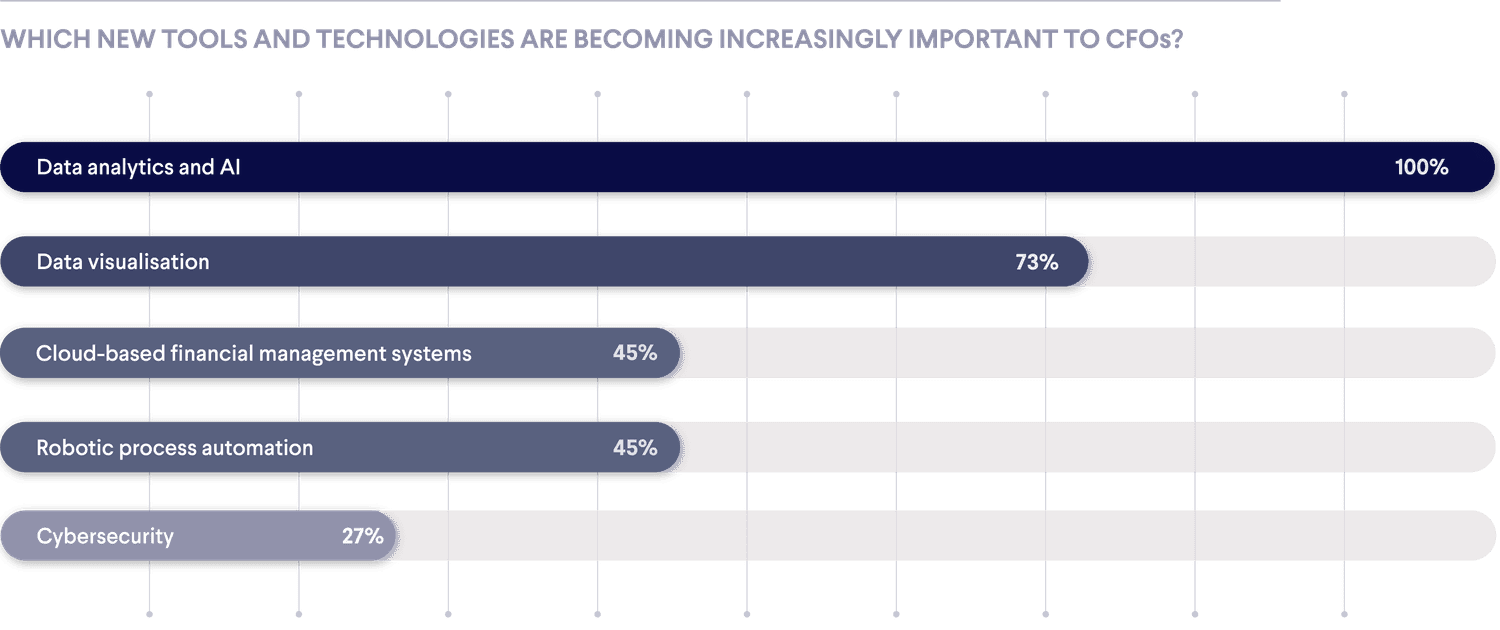

Bowmark CFOs are embracing new technologies and tools that can transform their businesses, with a particular focus on harnessing data analytics and AI, as well as data visualisation that can help with managing processes such as performance metrics and financial forecasting.

Uncovering and extracting value from data

The ability to unlock hidden value in data is emerging as a differentiator for companies and a way to drive long-term growth. Strong data management and analysis can enable companies to track KPIs and measure those against targets in the value creation plan. Furthermore, it can enable CFOs and management to model factors such as maximising lifetime value from customers, and help private equity-backed companies prepare for exit processes with detailed information that can enhance valuations.

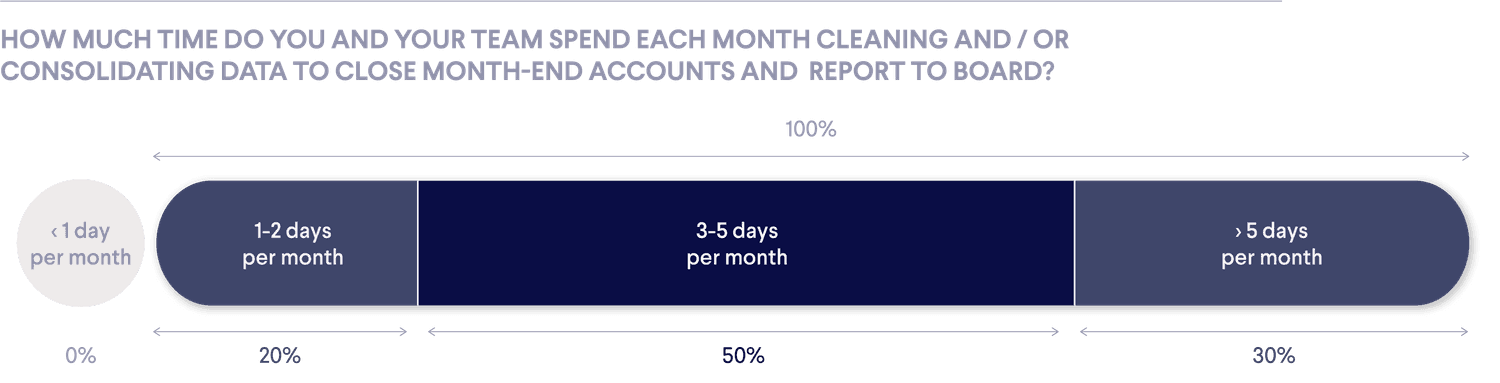

The challenge, however, is that the practical constraints on CFOs time and the reality of data collection and management means the task of preparing data and extracting insights often descends into time-consuming manual procedures. Many finance teams spend multiple days each month just on cleaning and preparing data for routine accounts and reports.

However, data management does not need to be time consuming, nor does automating processes need to be challenging. “There are some really small, pragmatic and tactical steps that you can take to generate value from data really quite quickly,” said Anush Newman, founder of data advisory firm JMAN Group. Quick win processes could involve standardising reporting procedures, automating routine processes, and upskilling team members to manage them.

Bowmark-backed Totalmobile, a provider of field management software, identified a number of inefficient manual finance procedures that could benefit from automation. Over a period of four weeks, the company introduced new software solutions and trained staff on how to manage processes in house. One central lesson they learnt is that it is better to train existing team members in software skills than to hire in people with specific software knowledge and educate them in the intricacies of the business.

Once “easy wins” have been achieved, companies can work on building more detailed data platforms and dashboards that facilitate reporting and compliance, which can also be used to extract valuable customer and business insights from the data. Over time, these platforms can form the basis for exit due diligence and driving value maximisation.

Incorporating ESG to drive value and retain talent

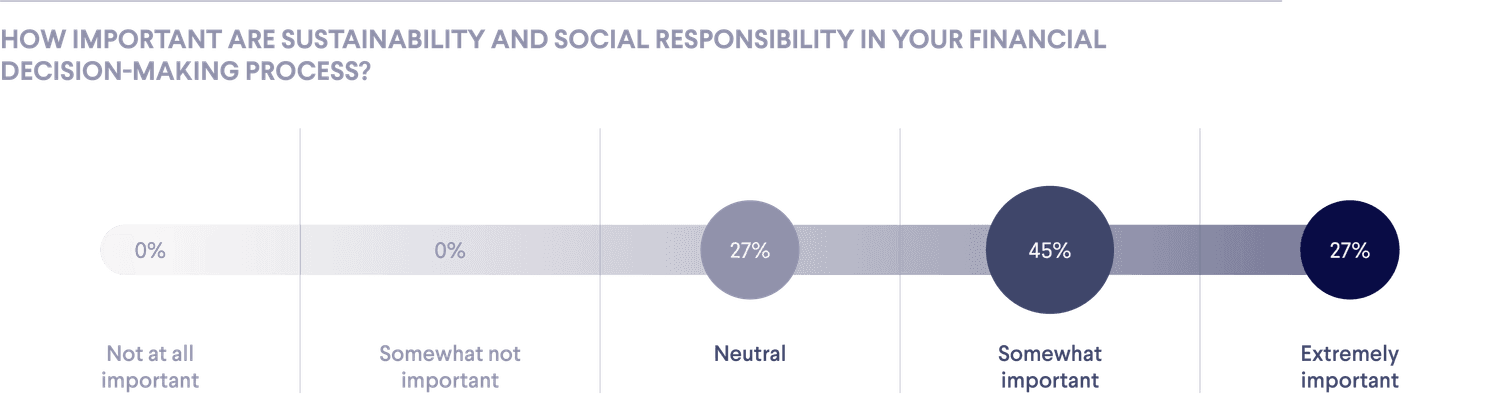

Intertwined with data management and value creation is the central importance of robust ESG processes. For Bowmark-backed businesses, sustainability and social responsibility are already important issues, with many companies also getting to grips with topics such as carbon footprinting.

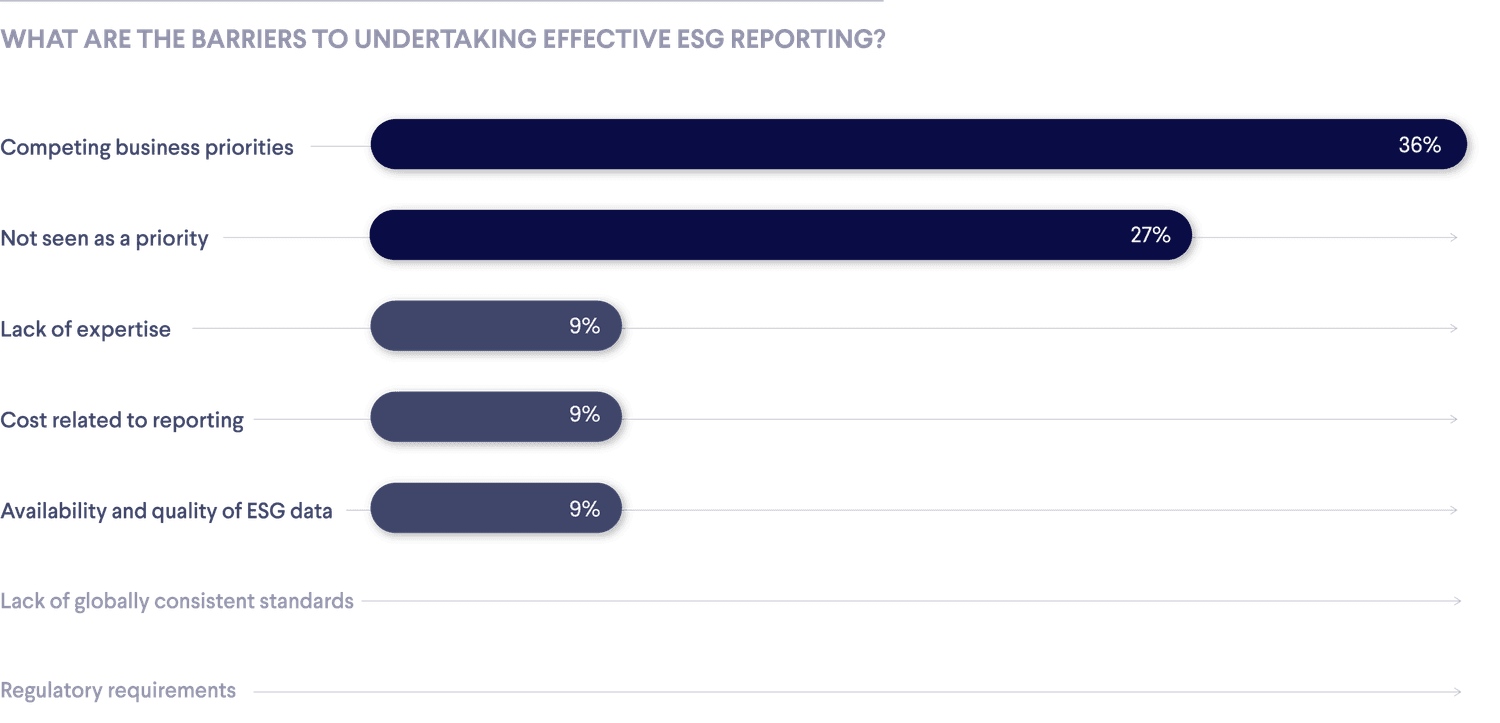

With multiple demands on CFO time and resources, competing business priorities were highlighted as the leading barrier to effective ESG reporting. Progress on ESG initiatives comes with not only a moral imperative, but also a commercial one. As we have seen with Bowmark’s portfolio, mid-market companies transacting with Tier 1 banks for example – either selling them software and services, or raising finance – need to show commitments that encompass action on the environment, social responsibility, and governance. ESG standards are also essential in talent acquisition and retention as employees, particularly younger ones, expect and demand engagement on issues like climate change and diversity and inclusion from their employers.

The result of stronger ESG standards is better financial performance. Ecovadis research shows that companies that are sustainable procurement leaders have higher margins than those that are laggards. Similarly, companies with more satisfied employees grow revenues more quickly and have higher profitability.

“What typically we find is that the businesses that invest in implementing ESG have lower employee churn and often higher sustained revenue and EBITDA growth as a result,” said Ben Hollowood of Bowmark’s portfolio management and value creation team.

One area of particular focus for companies is climate change. While current regulation is focused on larger corporations, it is likely that it will be extended to smaller companies in the near future, said Anne Sheedy, ESG advisor to Bowmark. “The better prepared companies are, and the better their information, the better they are going to cope with increased demands,” she said.

Science-based targets are emerging as practical way for companies to make commitments to net zero through emissions reduction. By adopting targets, and then monitoring and reporting progress towards those goals, companies can demonstrate their ESG credentials to ever more environmentally conscious consumers and investors. Furthermore, they will be prepared for the rising tide of regulation and be more resilient to climate risk. And ultimately, companies should see value benefits through increased efficiency and bottom line savings.

Early preparation to maximise exit value

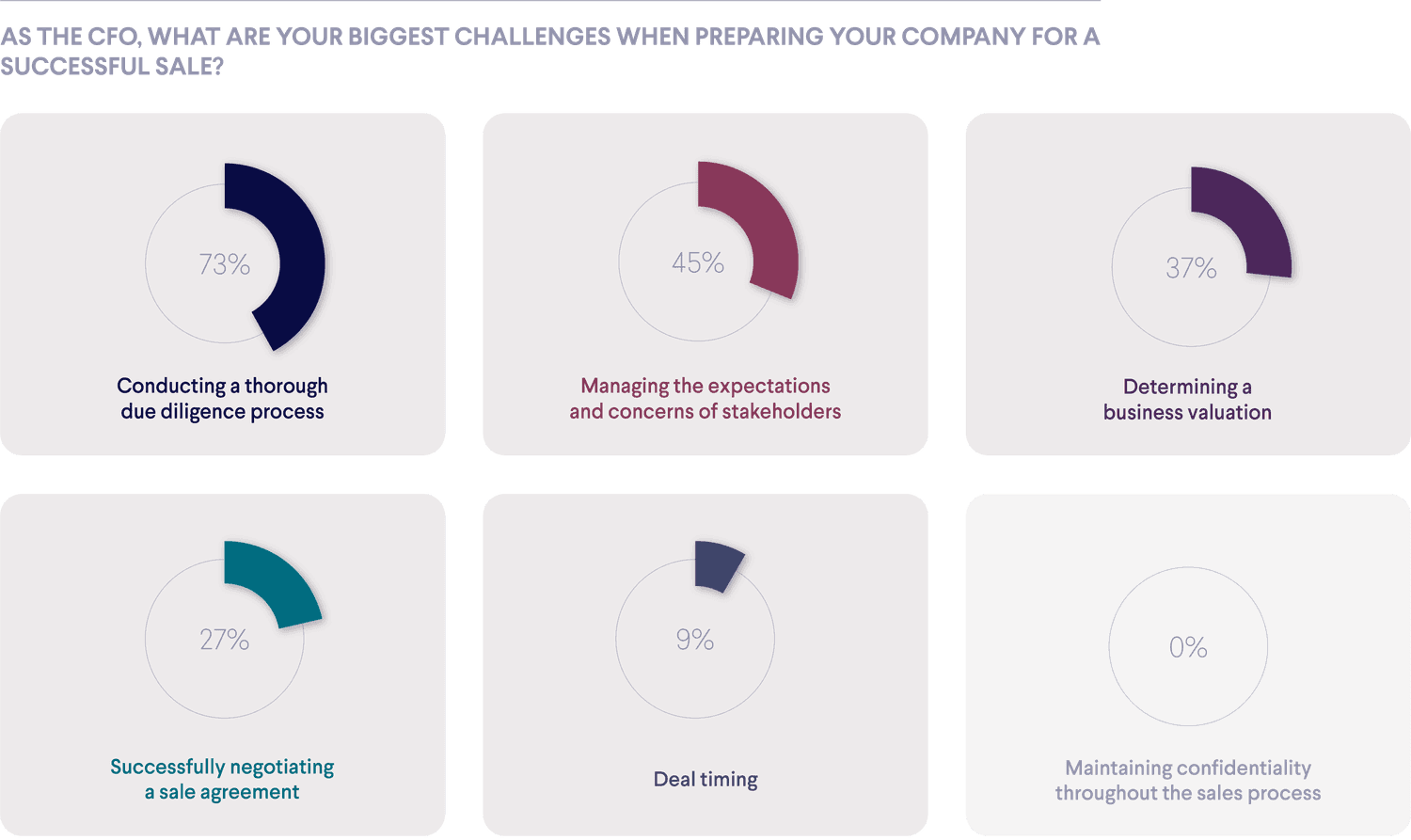

The culmination of any private equity value creation process is ultimately the exit. Our CFO survey found that conducting thorough due diligence was the greatest challenge for companies when preparing for a sale process, followed by managing expectations and concerns of stakeholders. These responsibilities go hand-in-hand with enabling management and employees to continue to focus on day-to-day operations with minimal disruption.

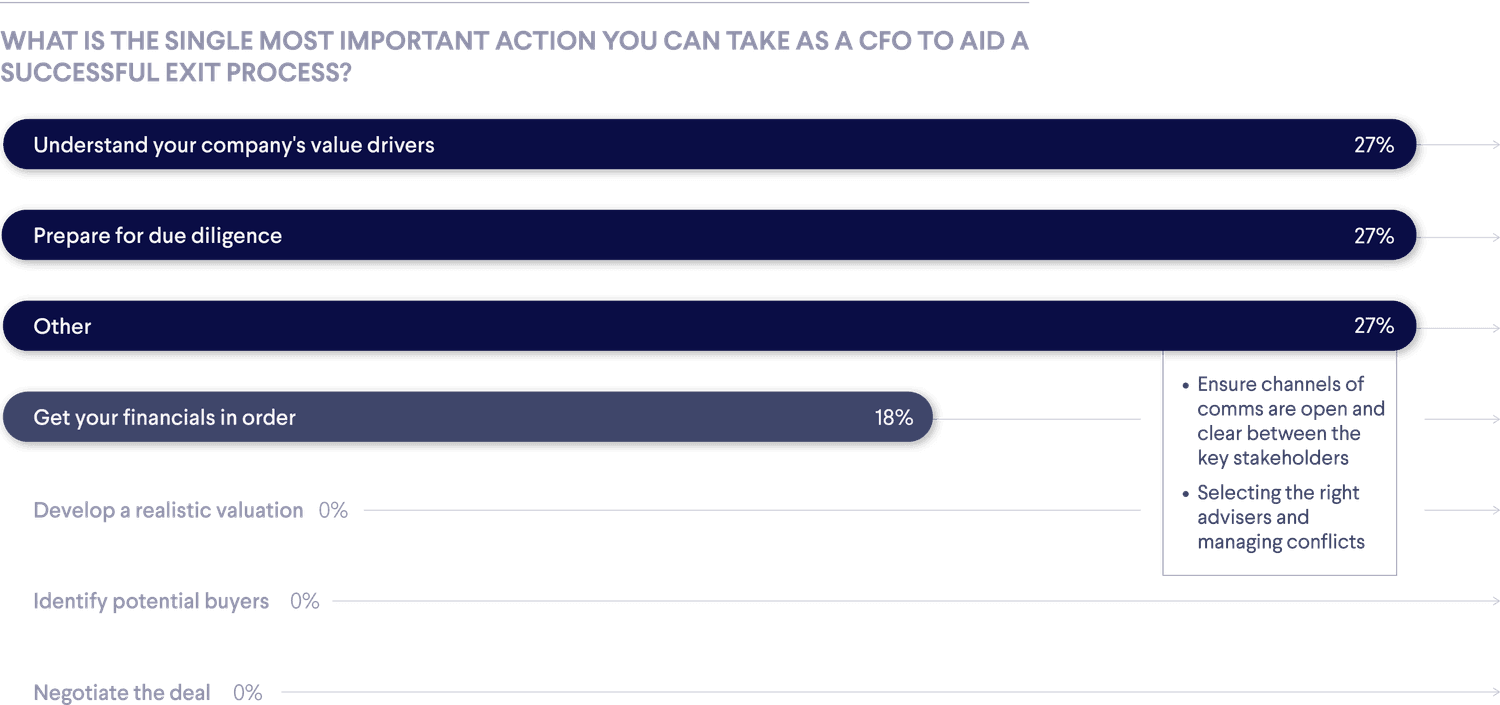

Getting prepared early for potential exits is critical to success at private equity-backed businesses. This involves drawing together large volumes of data spanning accounts, CRM and HR, as well as other company specific information for investor due diligence. CFOs that have already automated processes and created dashboards for routine reporting will have a head start, and will also have a clear picture of their company’s value drivers – among the most important actions highlighted in our survey.

Understanding that data and preparing it for potential investors enables CFOs and management teams to drive a successful exit process. Armed with a good understanding of their data the CFO can more easily explain the company’s future trajectory and opportunities and hence maximise the final valuation. “If you prepare early and have granular data around points such as revenue drivers or the reoccurring nature of the customer base, you can really crunch those numbers and use data analytics to support your value creation story,” concluded Andrew Howson, BDO Transaction Services Partner.